Cryptocurrency Transaction Monitoring for Money Laundering

Traditional banks have long avoided cryptocurrencies, but it has continuously been developing and growing into one of the major assets. Turning a blind eye away from cryptocurrency may not be a feasible option anymore.

Virtual roundtable - Cryptocurrency Transaction Monitoring for Money Laundering Prevention

May 26 at 3PM SGT/HKT

Join the upcoming Asia Risk and SAS roundtable on how banks and other financial institutions are considering how they will monitor cryptocurrency transaction to prevent fraud.

The event will bring risk management, compliance and AML leaders together to discuss the latest in crypto compliance and the market's position on providing crypto services.

Vinoy Kumar

Former Global Head Digital Assets

Standard Chartered

Irfan Ahmad

APAC Product Lead

State Street Digital

Eric Emer

Cryptocurrency Trading Desk

Three Arrow Capital

Ahmed Drissi

APAC AML Lead

SAS

Discussion highlights:

- The current regulatory landscape and how banks are managing the risk

- How are the banks responding and adapting to this new asset?

- Monitoring the illicit transactions happening daily within the bank

- What can banks do in providing services to an unknown lucrative asset?

Who should attend?

This roundtable event is designed for senior risk and investment professionals. Relevant departments include, but are not limited to:

- Asset allocation

- Investing/portfolio management

- Risk

- Market risk

- Liquidity risk

About Risk.net think tanks

Risk.net think tanks are virtual roundtables designed exclusively for senior executives. These virtual events provide an intimate, board room style setting for executives to discuss a specific trend or challenge in order to develop the best course of action to address it. The discussion is conducted under Chatham House rules which means it is off the record hence participants can share their views openly, freely and anonymously.

Risk.net would welcome senior practitioners to take part to exchange idea with peers and to move forward together during uncertain times.

Register for this roundtable event

The discussion is conducted under Chatham House rules which means it is off the record hence participants can share their views openly, freely and anonymously.

Partnership and registration enquiries

Stephen Body

Marketing Director, Asia-Pacific

TEL: +852 6113 1008

Hosted by:

The world's leading source of in-depth news and analysis on risk management, derivatives, regulation and investing.

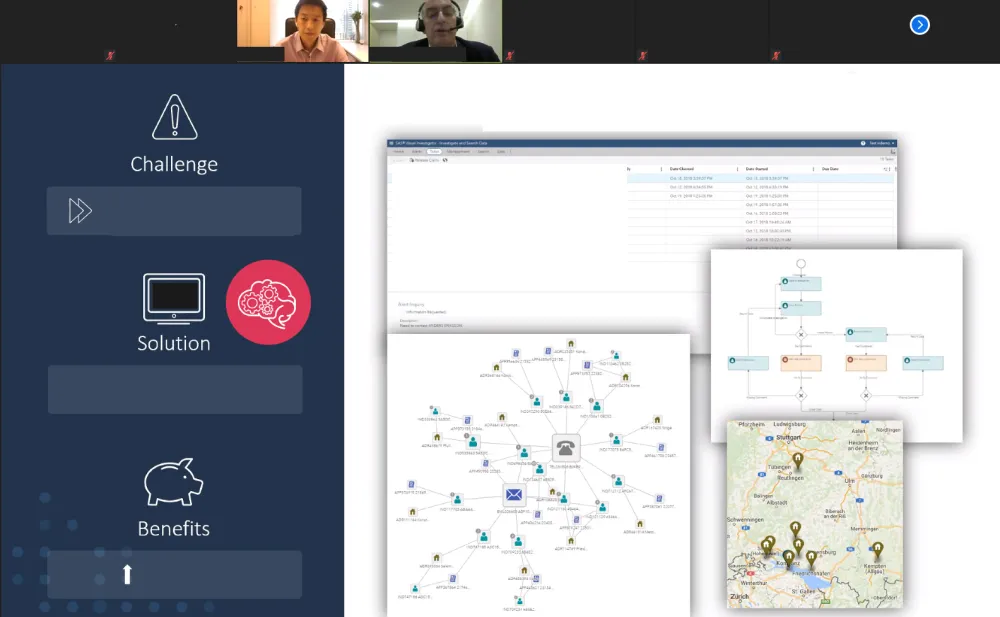

As a leader in analytics, SAS has more than 40 years of experience helping organisations solve their toughest problems. SAS' unrelenting commitment to innovation enables the financial services to modernise and sustain a competitive edge. SAS provides an integrated, enterprise-wide risk management platform for managing risk in an organisation, from strategic to reputational, operational, financial or compliance-related risk management. Learn more about how SAS is driving innovation and business value for risk and finance professionals at www.sas.com/risk.