Global Advisory Board 2023

Global Advisory Board 2023

Global Advisory Board 2023

Jessica James

Managing Director, Senior Qunatitative Researcher

Commerzbank AG

Jessica James is a Senior Quantitative Researcher at Commerzbank in London, previously Head of the Quantitative Solutions Group. She joined Commerzbank from Citigroup where she held a number of FX roles, latterly as Global Head of the Quantitative Investor Solutions Group. Prior to this she was the Head of Risk Advisory and Currency Overlay Team for Bank One. Before her career in finance, James lectured in physics at Trinity College, Oxford. She holds a BSc in Physics from Manchester University and a D. Phil. in atomic and nuclear phyics from Oxford University.

Her significant publications include the ‘Handbook of Foreign Exchange’ (Wiley), 'Interest Rate Modelling' (Wiley), and 'Currency Management' (Risk books). Her latest book ‘FX Option Performance’ came out in 2015. She has been closely associated with the development of currency as an asset class, being one of the first to create overlay and currency alpha products.

Jessica is on the Board of the Journal of Quantitative Finance, and is a Visiting Professor both at UCL and at

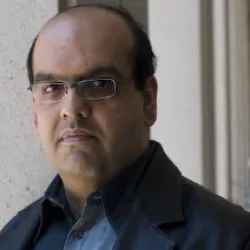

Youssef Elouerkhaoui

Managing director, global head of markets quantitative analysis

Citi

Youssef Elouerkhaoui is a Managing Director and the global head of markets quantitative analysis at Citi. His group supports all modelling and product development activities across businesses. He is also in charge of CVA, Funding and Regulatory Capital for his businesses. Prior to this, he was a Director in the Fixed Income Derivatives Quantitative Research Group at UBS, where he was in charge of model development for the Structured Credit Desk. Before joining UBS, Youssef was a Quantitative Research Analyst at Credit Lyonnais supporting Interest Rates Exotics. He is a graduate of Ecole Centrale Paris and he holds a PhD in Mathematics from Paris-Dauphine University.

Jim Gatheral

Presidential professor of mathematics

Baruch College, CUNY

Jim Gatheral is Presidential Professor of Mathematics at Baruch College, CUNY teaching mostly courses in the Masters of Financial Engineering (MFE) program. Prior to joining the faculty of Baruch College, Jim was involved in all of the major derivative product areas as bookrunner, risk manager, and quantitative analyst in London, Tokyo and New York, in a career in the financial industry that spanned over 27 years. Jim has served as a Managing Editor of the International Journal of Theoretical and Applied Finance and as Associate Editor of the SIAM Journal on Financial Mathematics; he currently serves as Joint Editor-in-Chief of Quantitative Finance with Michael Dempster. His current research focus is on volatility modeling and modeling equity market microstructure for algorithmic trading. Jim is also a frequent speaker at both practitioner and academic conferences around the world. His best-selling book, The Volatility Surface: A Practitioner's Guide (Wiley 2006) is one of the standard references on the subject of volatility modeling. He received his Ph.D. in theoretical physics from Cambridge University.

Wim Schoutens

Professor

University of Leuven

Wim Schoutens is a quantitative finance professor at the University of Leuven, Belgium.

He has extensive practical experience of model implementation and validation. He is well known for his consulting work with the banking industry and national and supra-national institutions. He is an independent expert advisor to the European Commission, has worked for the IMF and is the author of several books on quantitative finance.

His latest books, co-authored with Dilip Madan, are about the brand new theory of conic finance.

He is also a member of different editorial Boards of international finance journals. Wim is also a founding partner of RiskConcile, a fintech company with roots within the University of Leuven.

He likes arbitrages, politically incorrect statements and making jam.

Fabrizio Anfuso

Senior technical specialist, PRA

Bank of England

Fabrizio Anfuso, Senior Technical Specialist, PRA, BANK OF ENGLAND

Fabrizio is a leading expert in developing complex risk analytics, quantitative modelling and financial regulations. He has an extensive track-record of heading quant teams onshore and offshore, as well as of taking part in firm-wide programs, such as IMM, BCBS-IOSCO Margin Requirements and IBOR transition.

In his present and previous roles, Fabrizio has gained a comprehensive knowledge of the full model development cycle, including the model design, the validation of model performance, the IT implementation and the attainment of regulatory compliance.

His main areas of expertise are Counterparty credit risk, Monte Carlo simulations, Internal Models for the trading book (IMM and IMA), derivatives pricing, CCPs & collateral modelling, Initial Margin methodologies and regulatory capital.

Fabrizio is chairing the master’s course in Counterparty Credit Risk of the ETH / University of Zurich and taught a number of advanced professional trainings in topics such as CCR, capital management and Initial Margin methodologies.

As part of his academic activities, he has authored numerous research articles in the fields of quantitative finance and condensed matter physics. Fabrizio holds a Ph.D. in Theoretical Physics from the Chalmers University of Technology (Gothenburg, Sweden).

Vladimir Piterbarg

Managing director, head of quantitative analytics and quantitative development

NatWest Markets

Vladimir Piterbarg is the global head of Quantitative Analytics at NatWest Markets since 2018. He held similar positions at Rokos Capital Management LLP, Barclays Capital/Barclays investment bank, and Bank of America. Vladimir Piterbarg has a PhD in Mathematics (Stochastic Calculus) from the University of Southern California. He serves as an associate editor of the Journal of Computational Finance and the Journal of Investment Strategies. Together with Leif Andersen, Vladimir Piterbarg wrote the authoritative, three-volume set of books “Interest Rate Modelling”. He published multiple papers in various areas of quantitative finance, and won Risk Magazine’s Quant of the Year award twice.

Luca Capriotti

Managing Director - Global Head Quantitative Strategies, Credit

Credit Suisse

Luca Capriotti is a Managing Director at Credit Suisse, based in London, where he works in Quantitative Strategies and he is responsible for Credit Products in Europe, and globally for Corporate Bank and Treasury. Previous to this role, he was US head of Quantitative Strategies Global Credit Products, he has worked in Credit and Commodities Exotics in New York and London and in the cross-asset modeling R&D group of GMAG in the London office.

Luca is also visiting professor at the Department of Mathematics at University College London. His current research interests are in the fields of Machine Learning, Algorithmic Trading, Credit Models and Computational Finance, with a focus on applications of Adjoint Algorithmic Differentiation (AAD) for which he holds a US Patent.

Luca gives regularly gives seminars and courses worldwide. He has served as supervisor and external examiner for Master and PhD programs and as referee for several scientific publications .

Prior to working in Finance, Luca was a researcher at the Kavli Institute for Theoretical Physics, Santa Barbara, California, working in the field of High Temperature Superconductivity and Quantum Monte Carlo methods for Condensed Matter systems.

Luca holds a M.S. cum laude in General Physics from University of Florence (1996), and an M.Phil. and Ph.D. cum laude in Condensed Matter Theory, from the International School for Advanced Studies, Trieste (2000).

Chris Kenyon

Global head of quant innovation & global head of XVA quant research

MUFG

Chris Kenyon is Global Head of Quant Innovation at MUFG, and also Global Head of XVA Quant Modelling at MUFG. Previously Chris was head of XVA quant research at Lloyds Banking Group, worked at Credit Suisse and Depfa Bank plc where he was the post-crisis head of structured credit valuation after working on inflation-rates hybrids introducing new smile models. Chris formalized KVA and MVA with Andrew Green, as well as PFL as the replacement for PFE. More recently he introduced a climate change valuation adjustment (CCVA). Chris has a PhD from Cambridge University, published 17 papers in the Cutting Edge section of Risk magazine (twice joint top-cited author), holds 10 US patents, and was an author of the open source software QuantLib.

Alexander Antonov

Quantitative research and development lead

ADIA

Rama Cont

Chair of mathematical finance, Mathematical Institute

University of Oxford

Prof. Rama Cont holds the Chair of Mathematical Finance at Imperial College London and is director of the CFM-Imperial Institute of Quantitative Finance since 2012, after previous appointments at Ecole Polytechnique (France), Columbia University (New York) and Sorbonne (Paris).

His research in finance has focused on modeling of extreme market risks: market discontinuities and breakdowns, liquidity risk, endogenous risk and systemic risk. His 2006 paper on ‘model risk', an early reference on the topic, was the first to propose a quantitative approach to model risk.

Cont has served as a consultant to the BIS, the European Central Bank, the New York Federal Reserve, Norges Bank, the US Commodity Futures Commission (CFTC), the US Office of Financial Research, the IMF and a dozen major CCPs in Europe, Asia, the US and Latin America.

He was awarded the Louis Bachelier Prize by the French Academy of Sciences in 2010 and the Royal Society Award for Excellence in Interdisciplinary Research in 2017 for his research on mathematical modeling in finance.

Leif Andersen

Global co-head of the quantitative strategies group & Data Group

Bank of America Merrill Lynch

Leif B. G. Andersen is the Global Co-Head of The Quantitative Strategies Group at Bank of America Merrill Lynch, and is an adjunct professor at NYU’s Courant Institute of Mathematical Sciences and CMU’s Tepper School of Business. He holds MSc's in Electrical and Mechanical Engineering from the Technical University of Denmark, an MBA from University of California at Berkeley, and a PhD in Finance from Aarhus Business School. He was the co-recipient of Risk Magazine’s 2001 Quant of the Year Award, and has worked for more than 20 years as a quantitative researcher in the derivatives pricing area. He has authored influential research papers and books in all areas of quantitative finance, and is an Associate Editor of Journal of Computational Finance.

Dilip Madan

Professor at Robert H. Smith School of Business

UNIVERSITY OF MARYLAND

Dilip Madan, Professor at Robert H. Smith School of Business, UNIVERSITY OF MARYLAND

Dilip Madan is Professor of Finance at the Robert H. Smith School of Business. He specializes in Mathematical Finance. Currently he serves as a consultant to Morgan Stanley, Meru Capital and Caspian Capital. He has also consulted with Citigroup, Bloomberg, the FDIC and Wachovia Securities. He is a founding member and Past President of the Bachelier Finance Society. He received the 2006 von Humboldt award in applied mathematics, was the 2007 Risk Magazine Quant of the year, received the 2008 Medal for Science from the University of Bologna and held the 2010 Eurandom Chair. He is Man- aging Editor of Mathematical Finance, Co-editor of the Review of Derivatives Research, Associate Editor of the Journal of Credit Risk and Quantitative Finance. His work is dedicated to improving the quality of financial valuation models, enhancing the performance of investment strategies, and advancing the efficiency of risk allocation in modern economies. Recent major contributions have appeared inMathematical Finance, Finance and Stochastics, Quantitative Finance, the Journal of Computational Finance, The International Journal of Theoretical and Applied Finance, The Journal of Risk, The Journal of Credit Risk among other journals.

Anthony Ledford

Chief scientist

Man AHL

Dr. Anthony Ledford is Man AHL's Chief Scientist and Academic liaison. He is based in the Man research laboratory (Oxford) and has overall responsibility for Man AHL's strategic research undertaken there. Prior to joining Man AHL in 2001, he lectured in Statistics at the University of Surrey. Dr. Ledford read Mathematics at Cambridge University, holds a PhD from Lancaster University in the development and application of multivariate extreme value methods, and is a former winner of the Royal Statistical Society's Research Prize.

Cristian Homescu

Chief investment office, investment Solutions Group

Bank of America

Jean-Philippe Bouchaud

Chairman

Capital Fund Management

Jean-Philippe Bouchaud, Chairman, Capital Fund Management (Risk.net's 2017 Quant of the Year & Buy-Side Quant of the Year 2018)

Jean-Philippe is Chairman and Chief Scientist. He supervises our research department with Marc and maintains strong links between our research team and the academic world. He is also a professor at Ecole Polytechnique where he teaches Statistical Mechanics and a course on "Complex Systems". He joined CFM in 1994.

Quant of the Year 2017 - https://www.risk.net/risk-magazine/analysis/2479713/quant-of-the-year-jean-philippe-bouchaud

Buy-Side quant of the Year 2018 - https://www.risk.net/awards/5364591/buy-side-quant-of-the-year-jean-philippe-bouchaud

Igor Halperin

Quant

Fidelity Investments

Andrew Green

Managing Director and Lead GFI Quant

Scotiabank

Andrew Green is a Managing Director and lead XVA Quant at Scotiabank in London. He is the author of XVA: Credit, Funding and Capital Valuation Adjustments which is published by Wiley, co-editor of Landmarks in XVA which is published by Risk Books and co-author of a number of technical articles on XVA in recent years.

Marco Bianchetti

Head of IMA Market Risk, Market and Financial Risk Management

Intesa Sanpaolo

Marco holds a M.Sc. in theoretical nuclear physics (1995) and a Ph.D. in theoretical condensed matter physics (2000) from Università degli Studi di Milano. In 2000 he joined the Financial Engineering team of Banca Caboto (now IMI CIB Division of Intesa Sanpaolo), developing pricing models and applications for the fixed income trading desk. In 2008 he moved to the Financial and Market Risk Management area of Intesa Sanpaolo, where in 2015 he was appointed head of Fair Value Policy, developing the global fair/prudent/IPV policies and the valuation risk management framework of Intesa Sanpaolo Group. In 2021 he was appointed head of IMA Market Risk, in charge of regulatory market risk models and RWAs under Basel 2.5 and FRTB.

His work covers pricing and risk management of financial instruments, with a focus on market risk, valuation risk, interest rates, XVAs, quasi-Monte Carlo, financial bubbles and portfolio optimization. He is the author of a few research papers, adjunct professor at Università di Bologna (2015-present) and at Università di Torino (2018-2023), member of Conference/Ph.D/Master Advisory Boards, and a frequent speaker at international conferences and trainings in quantitative finance and risk management.

Blanka Horvath

Associate professor in mathematical and computational finance

University of Oxford

Dr Blanka Horvath is an associate professor in mathematical and computational finance at the University of Oxford. Blanka’s current research interests evolve around a new generation of option pricing models (Rough Stochastic Volatility models), and their asymptotic and numerical properties. Prior to her current appointment, she was at ETH Zurich, specialising in functional analytic and numerical properties of SABR-type stochastic models. Blanka holds a PhD in Mathematical Finance from ETH Zurich, a Diploma in Mathematics from the University of Bonn and an MSc in Economics from the University of Hong Kong.