Sponsor Opportunities

Get in touch to find out more

Navigating risk and reward during turbulent times

Where leaders of buy-side risk management and investment strategy meet, learn and get ahead in the new era of risk. Gathering senior professionals from leading asset managers, hedge funds, pension funds, insurance firms, mutual funds and equity firms, Investment Risk USA is the premier regional conference helping you better understand the complexities of risk management and risk transfer.

Audience profile

Expert speakers

330

Buy-side Risk Europe, in person and virtual

100

Speakers

40

Sessions

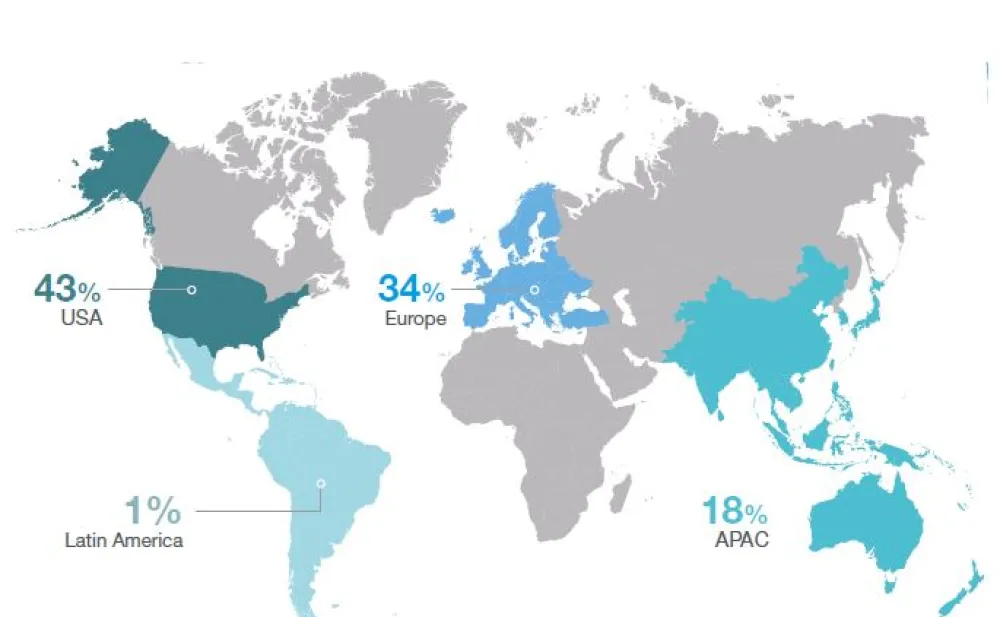

Buy-Side Risk global reach

Risk.net's vast database spans across the USA, Europe, Latin America and APAC.

USA - 43%

Europe - 34%

Latin America -1%

APAC - 18%

478736

contacts across the Risk.net database

14293

delegates attended a Risk.net event over the past year

12229

professionals follow topics on Risk.net

28240

professionals subscribe to Risk.net newsletters

Key topics include:

Climate risk: risk management & portfolio management

Technology change: digitalization for risk management, derivatives pricing, cyber resiliency

Regulation: are markets safer, more transparent and more stable?

ESG

The impact of macroeconomics and monetary policy on investing and risk management: one year on from Brexit, the change in China for investors, tail risks

Crypto currencies and other innovations impacting markets structures

The event had a really great set of speakers, and it is always great to hear directly from the regulators. There was plenty of time for networking as well, and the arrangements and facilities were excellent – the hotel was a great, well located venue and the rooms etc were very good. The whole event seemed to work like clockwork.

Past attendee

At Risk.net we believe information gives you an edge, particularly in complex markets. That’s why we cover risk management and risk transfer in more depth than anyone else – it helps our customers make better business decisions.

Kris Devasabai, Editor-in-chief, Risk.net

Buy-Side Risk Global is where asset managers meet to discuss the trends that threaten to upend their businesses this decade. Hear how some of the world’s biggest investors are reacting to climate change, cryptocurrencies and and the rise of the retail investor. Plus, where will the next financial shock come from.

Will Hadfield Editor, Risk.net

Previous attendees and sponsors

FactSet helps the financial community to see more, think bigger, and work better. Our digital platform and enterprise solutions deliver financial data, analytics, and open technology globally. Clients across the buy-side and sell-side as well as wealth managers, private equity firms, and corporations achieve more every day with our comprehensive and connected content, flexible next-generation workflow solutions, and client-centric specialized support. As a member of the S&P 500, we are committed to sustainable growth and have been recognized amongst the Best Places to Work in 2023 by Glassdoor.

IHS Markit is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80% of the Fortune Global 500, and the world's leading financial institutions.

ABOUT CONNING

Conning (www.conning.com) is a leading investment management firm with a long history of serving the insurance industry. Conning supports institutional investors, including pension plans, with investment solutions and asset management offerings, risk modeling software, and industry research. Conning’s risk management software platform provides deeper insights for decision making, regulatory and rating agency compliance, and capital allocation. Founded in 1912, Conning has investment centers in Asia, Europe and North America.

MSCI is a leading provider of critical decision-support tools and services for the global investment community. With over 50 years' expertise in research, data and technology, MSCI powers better investment decisions by enabling clients to understand and analyse key drivers of risk and return, and to confidently build more effective portfolios. MSCI creates industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

PIMCO is one of the world’s premier fixed income investment managers.

With our launch in 1971 in Newport Beach, California, PIMCO introduced investors to a total return approach to fixed income investing. In the 45+ years since, we have continued to bring innovation and expertise to our partnership with clients seeking the best investment solutions. Today we have offices across the globe and 2,300 professionals united by a single purpose: creating opportunities for investors in every environment.

BlackRock’s Official Institutions Group (“OIG”) partners with central banks, sovereign wealth funds, finance ministries, future generation funds and multi-lateral organizations, offering the full range of customized solutions and global investment management, risk management and advisory services.

Our clients can take advantage of BlackRock’s broad global investment platform and expertise across a robust set of asset classes spanning the full risk spectrum. We are aware of the unique set of requirements facing official institutions and can tailor an investment strategy within a given mandate to reflect the specific constraints and needs of our clients. As a fiduciary, we share the same objectives and challenges as our clients. By partnering with them and leveraging the experience of BlackRock investment professionals as well as Aladdin, our end-to-end operating system for investment management, we believe we can generate long-term solutions that allow us to achieve our client’s goals. BlackRock has provided investment solutions to official institutions worldwide since 1992 and manages $537 billion on behalf of these institutions as of 30 September 2022.

As of 31 December 2022:

- OIG manages c. $600 billion in assets under management, including self-reported iShares holdings, for 138 official institution clients worldwide (59 central banks, 27 sovereign wealth funds, 24 national pension funds, 28 multilateral development banks, ministries and agencies).

- OIG provides risk management tools in the form of BlackRock’s Aladdin and eFront solutions to 21 official institution clients worldwide.

- BlackRock’s Financial Markets Advisory ("FMA") team has completed 146 assignments for global official institution clients since 2013.

Dedicated team of seasoned OIG client relationship managers partner closely with BlackRock’s broader institutional client business to ensure holistic relationship coverage across headquarters and regional rep offices

For nearly four decades, State Street Global Advisors has been committed to helping financial professionals and those who rely on them achieve their investment objectives. We partner with institutions and financial professionals to help them reach their goals through a rigorous, research-driven process spanning both active and index disciplines. We take pride in working closely with our clients to develop precise investment strategies, including our pioneering family of SPDR ETFs. With millions* in assets under management, our scale and global footprint provide access to markets and asset classes, and allow us to deliver expert insights and investment solutions.

State Street Global Advisors is the investment management arm of State Street Corporation.

* Assets under management were $2.51 trillion as of December 31, 2018. AUM reflects approx. $32.45 billion (as of December 31, 2018) with respect to which State Street Global Advisors Funds Distributors, LLC (SSGA FD) serves as marketing agent; SSGA FD and State Street Global Advisors are affiliated.

Qontigo is an investment intelligence driver, OPTIMIZING IMPACTTM with it client partners. The combination of the world-class indices and best-of-breed analytics, underpinned by technological expertise and customer-driven innovation, enables its clients to achieve competitive advantage in a rapidly changing marketplace. Qontigo’s global client base includes the world’s largest financial products issuers, capital owners and asset managers. Created in 2019 through the combination of Axioma, DAX and STOXX, Qontigo is part of Deutsche Börse Group, headquartered in Eschborn with key locations in New York, Zug and London.

Quantifi is a provider of risk, analytics and trading solutions. Its award-winning suite of integrated pre- and post-trade solutions allow market participants to better value, trade and risk manage their exposures. Founded in 2002, Quantifi is trusted by the world’s most sophisticated financial institutions, including five of the six largest global banks, two of the three largest asset managers, leading hedge funds, insurance companies, pension funds and other institutions across 40 countries. By applying the latest technology innovations, Quantifi provides new levels of usability, flexibility, and integration. This translates into dramatically lower time to market, lower total cost of ownership and significant improvements in operational efficiency, allowing clients to focus on their core business.

Want to know more?

Sponsorship enquiries

Antony Chambers

Publisher, Risk.net/FX Markets/WatersTechnology