Speakers

Speakers 2022

Quant Summit Europe speakers include

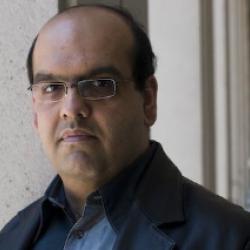

Mauro Cesa

Quantitative finance editor

Risk.net

Mauro Cesa is quantitative finance editor for Risk.net, based in London. He leads the team responsible for the publication of quantitative research across all brands of the division. The section of Risk.net he manages, Cutting Edge, publishes peer-reviewed papers on derivatives, asset and risk management, and commodities.

Mauro holds a degree in economics from the university of Trieste and a masters in quant finance from the University of Brescia.

Blanka Horvath

Associate professor in mathematical and computational finance

University of Oxford

Dr Blanka Horvath is an associate professor in mathematical and computational finance at the University of Oxford. Blanka’s current research interests evolve around a new generation of option pricing models (Rough Stochastic Volatility models), and their asymptotic and numerical properties. Prior to her current appointment, she was at ETH Zurich, specialising in functional analytic and numerical properties of SABR-type stochastic models. Blanka holds a PhD in Mathematical Finance from ETH Zurich, a Diploma in Mathematics from the University of Bonn and an MSc in Economics from the University of Hong Kong.

Stefan Zohren

Deputy director

Oxford-Man Institute of Quantitative Finance

Stefan Zohren is deputy director of the Oxford-Man Institute of Quantitative Finance and an associate professor at the Department of Engineering Science at the University of Oxford. He is a fellow of the Turing Institute, the UK’s national institute for artificial intelligence (AI) and data science. Zohren’s research is focused on machine learning in finance, including deep learning, reinforcement learning, network and natural language processing approaches, and early use cases of quantum computing. He works with Man Group on commercial research projects and is a frequent speaker on AI in finance, representing the Oxford-Man Institute at academic conferences, industry panels and corporate events.

Alexander Sokol

Executive chairman and head of quant research

CompatibL

Alexander Sokol is the founder, Executive Chairman, and Head of Quant Research at CompatibL.

In 2022, he has been awarded the Fintech Person of the Year Award for his expertise and developments on a new class of machine learning risk models that can work with short pandemic-era historical time series. Alexander also won the Quant of the Year Award in 2018 together with Leif Andersen and Michael Pykhtin, for their joint work revealing the true scale of the settlement gap risk that remains even in the presence of initial margin.

Alexander’s other notable research contributions include systemic wrong-way risk (with Michael Pykhtin, Risk Magazine), joint measure models, and the local price of risk (with John Hull and Alan White, Risk Magazine), and mean reversion skew (Risk Books, 2014).

Chris Kenyon

Global head of quant innovation & global head of XVA quant research

MUFG

Chris Kenyon is Global Head of Quant Innovation at MUFG, and also Global Head of XVA Quant Modelling at MUFG. Previously Chris was head of XVA quant research at Lloyds Banking Group, worked at Credit Suisse and Depfa Bank plc where he was the post-crisis head of structured credit valuation after working on inflation-rates hybrids introducing new smile models. Chris formalized KVA and MVA with Andrew Green, as well as PFL as the replacement for PFE. More recently he introduced a climate change valuation adjustment (CCVA). Chris has a PhD from Cambridge University, published 17 papers in the Cutting Edge section of Risk magazine (twice joint top-cited author), holds 10 US patents, and was an author of the open source software QuantLib.

Vladimir Piterbarg

Managing director, head of quantitative analytics and quantitative development

NatWest Markets

Vladimir Piterbarg is the global head of Quantitative Analytics at NatWest Markets since 2018. He held similar positions at Rokos Capital Management LLP, Barclays Capital/Barclays investment bank, and Bank of America. Vladimir Piterbarg has a PhD in Mathematics (Stochastic Calculus) from the University of Southern California. He serves as an associate editor of the Journal of Computational Finance and the Journal of Investment Strategies. Together with Leif Andersen, Vladimir Piterbarg wrote the authoritative, three-volume set of books “Interest Rate Modelling”. He published multiple papers in various areas of quantitative finance, and won Risk Magazine’s Quant of the Year award twice.

Rama Cont

Chair of mathematical finance, Mathematical Institute

University of Oxford

Prof. Rama Cont holds the Chair of Mathematical Finance at Imperial College London and is director of the CFM-Imperial Institute of Quantitative Finance since 2012, after previous appointments at Ecole Polytechnique (France), Columbia University (New York) and Sorbonne (Paris).

His research in finance has focused on modeling of extreme market risks: market discontinuities and breakdowns, liquidity risk, endogenous risk and systemic risk. His 2006 paper on ‘model risk', an early reference on the topic, was the first to propose a quantitative approach to model risk.

Cont has served as a consultant to the BIS, the European Central Bank, the New York Federal Reserve, Norges Bank, the US Commodity Futures Commission (CFTC), the US Office of Financial Research, the IMF and a dozen major CCPs in Europe, Asia, the US and Latin America.

He was awarded the Louis Bachelier Prize by the French Academy of Sciences in 2010 and the Royal Society Award for Excellence in Interdisciplinary Research in 2017 for his research on mathematical modeling in finance.

Oleksiy Kondratyev

Quantitative research & development lead

Abu Dhabi Investment Authority (ADIA)

Alexei is Quantitative Research & Development Lead at ADIA.

Formerly a Managing Director and Global Head of Data Analytics at Standard Chartered Bank, Alexei is responsible for providing data analytics services to Corporate, Commercial and Institutional Banking division of Standard Chartered Bank.

He joined Standard Chartered Bank in 2010 from Barclays Capital where he managed a model development team within Credit Risk Analytics. Prior to joining Barclays Capital in 2004, he was a senior quantitative analyst at Dresdner Bank in Frankfurt.

Alexei holds MSc in Theoretical Nuclear Physics from the University of Kiev and PhD in Mathematical Physics from the Institute for Mathematics, National Academy of Sciences of Ukraine.

He was the recipient of the 2019 Quant of the Year award from Risk magazine.

Mathieu Rosenbaum

Professor of finance

Ecole Polytechnique

Mathieu Rosenbaum is a full professor at École Polytechnique, where he holds the chair “Analytics and Models for Regulation”

and is co-head of the quantitative finance (El Karoui) master program. His research mainly focuses on statistical finance problems, regulatory issues and risk management of derivatives.

He published more than 80 articles on these subjects and supervised about 20 PhD students.

He is notably a renowned experts on the quantitative analysis of market microstructure and high frequency trading.

Mathieu Rosenbaum is also at the origin (with Jim Gatheral and Thibault Jaisson) of the development of rough volatility models.

He is one of the editors in chief of the journal “Market Microstructure and Liquidity“ and is associate editor for 10 other journals.

Furthermore, he received the Europlace Award for Best Young Researcher in Finance in 2014, the European Research Council Grant in 2016, the Louis Bachelier prize in 2020 and the Quant of the Year award in 2021.

Carlo Acerbi

Researcher, fellow and author

Larix Risk Consulting, Geneva and EPFL Lausanne

Carlo Acerbi is a quantitative financial risk management researcher and professional, author of relevant contributions in the field of banking regulation (2002 coherent definition of ES ; 2019 ES backtesting), asset management liquidity regulation (2013 MSCI LiquidityMetrics) and stress testing (2016 MSCI ST best practices), among others.

He received a PhD in Theoretical Physics (1998, ISAS-SISSA, Trieste, Italy). He served for leading institutions in the financial risk industry (Banca Intesa, Abaxbank, McKinsey, RiskMetrics-MSCI, Banque Pictet). He teaches Advanced Derivatives at Bocconi University, Milan, Advanced Risk Management Topics at EPFL Lausanne (from Q4 2023) and he's Honorary Professor at Corvinus University, Budapest.

Francesco Capponi

Quantitative researcher – trading

BlackRock

Francesco Capponi, PhD, is a member of BlackRock’s Trading Research team.

Francesco is responsible for trading research in both Equities and FX, with an emphasis on market microstructure, transaction cost analysis, and execution research.

Prior to joining BlackRock, he worked at Barclays as a quantitative researcher within the quantitative portfolio construction team.

He holds an MPhil in Economics from the University of Cambridge, and a PhD in Mathematical Finance from Imperial College London.

Purba Das

Lecturer in financial mathematics

King's College London

Purba Das is a Lecturer in Financial Mathematics at King's College London. Purba's current research interests are Pathwise methods in stochastic analysis and it's application in Finance. Previously, she was a Research Assistant Professor of Mathematics at the University of Michigan (2022-2023). Purba completed her DPhil in Mathematical Institute at the University of Oxford (2018- 2022). Previously Purba received her Master’s, and Bachelor’s degree from Chennai Mathematical Institute, India.

Fabrizio Anfuso

Senior technical specialist, PRA

Bank of England

Fabrizio Anfuso, Senior Technical Specialist, PRA, BANK OF ENGLAND

Fabrizio is a leading expert in developing complex risk analytics, quantitative modelling and financial regulations. He has an extensive track-record of heading quant teams onshore and offshore, as well as of taking part in firm-wide programs, such as IMM, BCBS-IOSCO Margin Requirements and IBOR transition.

In his present and previous roles, Fabrizio has gained a comprehensive knowledge of the full model development cycle, including the model design, the validation of model performance, the IT implementation and the attainment of regulatory compliance.

His main areas of expertise are Counterparty credit risk, Monte Carlo simulations, Internal Models for the trading book (IMM and IMA), derivatives pricing, CCPs & collateral modelling, Initial Margin methodologies and regulatory capital.

Fabrizio is chairing the master’s course in Counterparty Credit Risk of the ETH / University of Zurich and taught a number of advanced professional trainings in topics such as CCR, capital management and Initial Margin methodologies.

As part of his academic activities, he has authored numerous research articles in the fields of quantitative finance and condensed matter physics. Fabrizio holds a Ph.D. in Theoretical Physics from the Chalmers University of Technology (Gothenburg, Sweden).

Johanes Muhle-Karbe

Head of mathematical finance

Imperial College

Johannes is the Head of the Mathematical Finance Section at Imperial College London, where he also directs the CFM-Imperial Institute on Quantitative Finance. Before his appointment at Imperial, Johannes held faculty positions at Carnegie Mellon University, the University of Michigan and ETH Zurich. His research focuses on the impact of "market frictions” such as trading costs or asymmetric information on optimal trading strategies.

Wim Schoutens

Professor

University of Leuven

Wim Schoutens is a quantitative finance professor at the University of Leuven, Belgium.

He has extensive practical experience of model implementation and validation. He is well known for his consulting work with the banking industry and national and supra-national institutions. He is an independent expert advisor to the European Commission, has worked for the IMF and is the author of several books on quantitative finance.

His latest books, co-authored with Dilip Madan, are about the brand new theory of conic finance.

He is also a member of different editorial Boards of international finance journals. Wim is also a founding partner of RiskConcile, a fintech company with roots within the University of Leuven.

He likes arbitrages, politically incorrect statements and making jam.

Lorenzo Ravagli

Head of European FX vol strategy

J.P. Morgan

Lorenzo Ravagli is an Executive Director in the Quantitative and Derivatives Strategy team, Head of European FX vol strategy, focusing on macro ideas and systematic strategies in the volatility space. Lorenzo joined J.P. Morgan in May 2018 after working as a senior Quantitative Strategist at Société Générale since 2008. He graduated from Florence University with a PhD in Theoretical Physics. He has published in top journals on physics and quantitative finance.

Youssef Elouerkhaoui

Managing director, global head of markets quantitative analysis

Citi

Youssef Elouerkhaoui is a Managing Director and the global head of markets quantitative analysis at Citi. His group supports all modelling and product development activities across businesses. He is also in charge of CVA, Funding and Regulatory Capital for his businesses. Prior to this, he was a Director in the Fixed Income Derivatives Quantitative Research Group at UBS, where he was in charge of model development for the Structured Credit Desk. Before joining UBS, Youssef was a Quantitative Research Analyst at Credit Lyonnais supporting Interest Rates Exotics. He is a graduate of Ecole Centrale Paris and he holds a PhD in Mathematics from Paris-Dauphine University.

Laura Ballotta

Professor in mathematical finance

Bayes Business School (formerly Cass)

Laura Ballotta is a Professor of Mathematical Finance at the Faculty of Finance of Bayes Business School (formerly Cass). She works in the areas of quantitative finance and risk management. She has written on topics including stochastic modelling for financial valuation and risk management, numerical methods aimed at supporting financial applications, and the interplay between finance and insurance.

Stéphane Crépey

Distinguished Professor of mathematics

Université Paris Cité

Stéphane Crépey is Professor of Mathematics at Université Paris Cité, Laboratoire de Probabilités, Statistique et Modélisation (LPSM), Team Mathematical Finance and Numerical Probability. His research interests are counterparty credit risk, XVA analysis, central counterparties, quantitative reverse stress tests; Model risk and uncertainty quantification; Backward stochastic differential equations (reflected, anticipated, in combination with progressive enlargement of filtration,...); Machine learning for finance (learning conditional expectations and risk measures, calibration by neural networks or Gaussian processes, anomaly detection,...). He is the author of numerous research papers published in journals including Annals of Probability, Finance and Stochastics, Mathematical Finance, Stochastic Processes and their Applications or Risk Magazine. He wrote two books: Financial Modeling: A Backward Stochastic Differential Equations Perspective (S. Crépey, Springer Finance Textbook Series, 2013) and Counterparty Risk and Funding, a Tale of Two Puzzles (S. Crépey, T. Bielecki and D. Brigo, Chapman & Hall/CRC Financial Mathematics Series, 2014). He is a member of the scientific council of the French financial markets authority (AMF). Stéphane graduated from ENSAE ParisTech and holds a PhD in differential games and mathematical finance from Ecole Polytechnique and INRIA Sophia Antipolis.

Matthias Arnsdorf

Global head of counterparty credit risk quantitative research

JP Morgan

Matthias Arnsdorf is a Managing Director and the global head of the Counterparty Credit Risk Quantitative Research team at J.P. Morgan. His responsibilities include the development of credit exposure and funding models for valuation, risk management as well as credit risk capital. He has published and presented numerous articles on credit risk and credit derivatives.

Matthias started his career in finance in 2002 working in credit derivatives quantitative research. Prior to this he spent two years as a post-doctoral researcher at the Niels Bohr Institute in Copenhagen. Matthias holds a PhD in Quantum Gravity from Imperial College London.

Jaya Nagaradjasarma

Head of EMEA equities algo quant research

Bank of America

Jaya Nagaradjasarma is the head of EMEA Equities Algo Quant Research for the Equity eTrading line of business at Bank of America London. She and her team create quantitative solutions that leverage data science, AI, and machine learning to optimise equities execution algorithms. Before joining Bank of America, Jaya worked in quantitative roles for automated trading desks in several asset classes on the buy side. Her earlier career includes roles at Susquehanna International Group in Dublin, Man AHL in Oxford, and Antares Technologies in Paris. Jaya received her master’s degree from Ecole Nationale de la Statistique et de l'Administration Economique, her DEA in Probability and Finance from Pierre et Marie University (DEA El Karoui), and her Ph.D. in Statistics from the London School of Economics. Jaya currently resides in London.

Damien Besombes

Vice president, quantitative strategies and data group, EMEA equities execution

Bank of America

Damien Besombes is a Vice President in the Quantitative Strategies and Data Group for EMEA Equities Execution at BofA Securities. Damien has 6 years of experience designing and building execution algorithms. He also previously worked as a Software Developer at the bank and as a Quant Developer in Energy trading at TotalEnergies. Damien graduated from Supélec in France.

Huyên Pham

Professor of applied mathematics

Université Paris Cité

Huyên PHAM is a distinguished Professor of Mathematics at Université Paris Cité. He is also Adjunct Professor at ENSAE and was Chair of Applied Mathematics at the John Von Neumann Institute of VNU-HCM. He leads research in quantitative finance, stochastic analysis and control, machine learning, and is the author of more than 110 publications, including the monograph Continuous time Stochastic Control and Optimization with Financial Applications. He serves on the editorial boards of several international journals and is the co-editor in chief of the journal Applied Mathematics and Optimization. Prof. Pham was appointed member of the Institut Universitaire de France in 2006, awarded the Louis Bachelier prize by the French Academy of Sciences in 2007, and was a plenary speaker at the 9th World congress of the Bachelier Finance Society in 2016, and at the 6th Asian Quantitative Finance Conference in 2018.

Milena Vuletić

DPhil candidate, mathematics of random systems

University of Oxford

Milena Vuletić is a DPhil Student in the Centre for Doctoral Training in Mathematics of Random Systems at the University of Oxford. She is supervised by Prof. Rama Cont and Prof. Mihai Cucuringu. Her research is focused on mathematical and data-driven modelling of multi-asset markets.

Lorenzo Torricelli

Assistant professor

University of Bologna

Lorenzo is a Lecturer in Mathematics at the University of Bologna. He was previously appointed at the University of Parma and holds a Post-Doc from LMU Munich. Before joining academia, he worked for the Italian Pension Regulator (COVIP) and took part in the EIOPA-Occupational Pension Committees for the revision of the European Union IORP directive on European Pension Funds.

His research interests are the modelling of the implied volatility surface, applications of jump processes in finance, time changed processes, tempered stable laws, fractional calculus and anomalous diffusions and their applications to finance. He is also interested in economic and mathematical models for public pension systems.

Lorenzo holds an MSc in Mathematics and Finance from Imperial College London and one in Pure Mathematics with a major in Geometry from the University of Roma Tre. His PhD in Mathematics was obtained from UCL London.

Erik Vynckier

Board member

Foresters Friendly Society

Erik Vynckier is board member of Foresters Friendly Society, general partner of InsurTech Venture Partners and chair of the Institute and Faculty of Actuaries, following a career in investment banking, insurance, asset management and the petrochemical industry. He co-founded European Union initiatives on high performance computing and big data in finance, and co-authored High-performance computing in finance and Tercentenary essays on the philosophy and science of Leibniz. Erik holds a master of business administration from the London Business School and as chemical engineer from Universiteit Gent.

Nikolai Nowaczyk

Technical specialist

Nikolai Nowaczyk is a Risk Management consultant who has advised more than 10 clients in over 20 projects around counterparty credit risk, xVA and model validation. He is broadly interested in classical methods of financial mathematics and statistics as well as data science and machine learning. Nikolai holds a PhD in mathematics from the University of Regensburg, has been an academic visitor to Imperial College London and likes to build bridges between academic research and practical applications.